WATER DAMAGE, ROOF LEAKS, PIPE BREAKS, FIRE, FLOOD, MOLD, WIND, HURRICANE, THEFT & VANDALISM

A PROFESSIONAL ADJUSTER WILL CONTACT YOU IMMEDIATELY

Life is filled with unforeseeable events, such as a fender-bender on the way to work or sudden water damage at home. In these situations, it's important to know that you can rely on your insurance policy to protect you.

South Florida Public Adjusting Services helps you work through all the technical details of the insurance claim process to make sure that you are property covered and compensated for your loss.

We have the knowledge and experience to properly represent our clients in all types of residential and commercial claims, regardless of the size or type of loss.

It is important to work with a company that is reliable and reputable who can make sure that you are kept fully up to date with the entire process and ensures that your claim is maximized and proper settlement is achieved.

Miami Herald: PUBLIC ADJUSTERS LAND LARGER SETTLEMENTS!

From the Miami Herald on January 15, 2010:

The Miami Herald quoted an audit that was conducted recently by the Florida Legislature has found that it is clearly within the policy holder's interest to hire a Public Adjuster to represent them during the claim process.

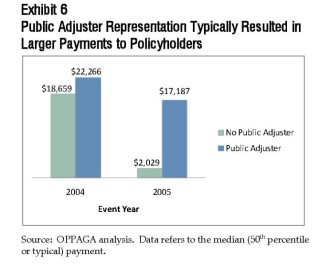

The numbers quoted by the article were quite shocking and beyond even my own expectations. To put it plain and simple, the article stressed that in comparing claims filed with Citizens Insurance, those using a Public Adjuster received 574% more than those not using a Public Adjuster and, furthermore, those numbers increased to 747% more on catastrophe claims such as those filed in 2005 for Hurricane damage.

To read the actual report, click here:

http://www.oppaga.state.fl.us/Summary.aspx?reportNum=10-06

NOW THAT YOU HAVE THIS INFORMATION, PICK UP THE PHONE AND CALL US TODAY!

News Archives - Claims Journal

Survey: Most Small Businesses Provide Regular Safety Training to Employees (Thu, 25 Apr 2024)A new report on small business owners’ workers’ compensation insurance-buying habits and risk exposures found that 95% offer regular safety training to their employees, according to The Hanover Insurance Group. Training for employees was ranked as the top service used …

>> Read more

Farm Bureau Must Defend Insured in Deadly Legionnaires’ Disease Outbreak in Carolina (Thu, 25 Apr 2024)

What started out as festive time at the North Carolina Mountain State Fair in 2019 ended with 96 people hospitalized with Legionnaires’ disease. Four of them died. The tragedy in Fletcher, North Carolina, made national headlines. Multiple victims filed suit …

>> Read more

Report: National Security Risks Grow with Demand for Nuclear Energy (Thu, 25 Apr 2024)

Risks associated with nuclear energy such as the proliferation of nuclear weapons, nuclear terrorism, sabotage, coercion and military operations can all be expected to grow as countries seek to implement their new nuclear energy objectives, according to a report by …

>> Read more

Jury Rules BNSF Contributed to 2 Deaths in Montana Town Where Asbestos Sickened Thousands (Thu, 25 Apr 2024)

A federal jury said BNSF Railway contributed to the deaths of two people who were exposed to asbestos decades ago when tainted mining material was shipped through a Montana town where thousands have been sickened. The jury awarded $4 million …

>> Read more

2024 Wildfire Forecast Calls for ‘Below Average’ Season (Thu, 25 Apr 2024)

The approaching wildfire season may bring hazardous air quality from blazes burning across the U.S., but it’s expected to be below the historical average in terms of the number of fires and acres burned. AccuWeather’s forecast for the 2024 wildfire …

>> Read more

Should I Hire An Attorney or A Public Adjuster?

Here is a really good video that explains when to use a Public Adjuster and when to use an Attorney to handle your insurance claim. I would say that in almost 95% of situations, you would use a Public Adjuster before an Attorney.

Attorney's usually do not understand how to adjust a claim or speak the same language as adjusters. Rather, an Attorney is necessary when a claim is denied and cannot be re-opened or if all options under the policy have been exhausted and you are still not happy with the outcome.

IN CONCLUSION, HIRE A PUBLIC ADJUSTER TODAY!

Hurricane Wilma: Is It Too Late To File A Claim Or Re-Open My Claim?

The simple answer to this question is NO!

You have up to five years to file a claim and/or re-open a previously filed claim. Since Hurricane Wilma took place on October 24, 2005; you technically have until October 24, 2010 to notify the Insurer Carrier you had at the time of Wilma that you would like to file a claim and/or are interested in re-opening a claim.

I will be cautious to advise that this is not a quick and easy process. Additionally, there are certain insurance companies, such as POE, that are no longer in business and it is too late to file a claim or re-open a claim with such carriers.

However, if you have documentation, invoices, pictures, receipts, etc. for the monies expended and evidence of the damaged that occurred, you are in a much better position.

Give us a call today so we can assist you with this process. Our team of professionals are trained and experienced in dealing with such claims.