WATER DAMAGE, ROOF LEAKS, PIPE BREAKS, FIRE, FLOOD, MOLD, WIND, HURRICANE, THEFT & VANDALISM

A PROFESSIONAL ADJUSTER WILL CONTACT YOU IMMEDIATELY

Life is filled with unforeseeable events, such as a fender-bender on the way to work or sudden water damage at home. In these situations, it's important to know that you can rely on your insurance policy to protect you.

South Florida Public Adjusting Services helps you work through all the technical details of the insurance claim process to make sure that you are property covered and compensated for your loss.

We have the knowledge and experience to properly represent our clients in all types of residential and commercial claims, regardless of the size or type of loss.

It is important to work with a company that is reliable and reputable who can make sure that you are kept fully up to date with the entire process and ensures that your claim is maximized and proper settlement is achieved.

Miami Herald: PUBLIC ADJUSTERS LAND LARGER SETTLEMENTS!

From the Miami Herald on January 15, 2010:

The Miami Herald quoted an audit that was conducted recently by the Florida Legislature has found that it is clearly within the policy holder's interest to hire a Public Adjuster to represent them during the claim process.

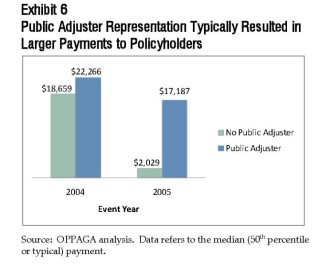

The numbers quoted by the article were quite shocking and beyond even my own expectations. To put it plain and simple, the article stressed that in comparing claims filed with Citizens Insurance, those using a Public Adjuster received 574% more than those not using a Public Adjuster and, furthermore, those numbers increased to 747% more on catastrophe claims such as those filed in 2005 for Hurricane damage.

To read the actual report, click here:

http://www.oppaga.state.fl.us/Summary.aspx?reportNum=10-06

NOW THAT YOU HAVE THIS INFORMATION, PICK UP THE PHONE AND CALL US TODAY!

News Archives - Claims Journal

6 in 10 Construction Workers Report Anxiety, Depression in Past Year (Tue, 04 Nov 2025)Nearly two-thirds of construction workers reported experiencing anxiety or depression in the past 12 months, according to a new survey by design-build firm Clayco. Sixty-four percent of the more than 1,000 construction workers surveyed said they felt the impact of …

>> Read more

Judge Orders Greenpeace to Pay $345M in Pipeline Lawsuit (Tue, 04 Nov 2025)

A North Dakota judge has ordered Greenpeace to pay damages of $345 million, reducing an earlier jury award after it found the environmental group and related entities liable for defamation and other claims in connection with protests of an oil …

>> Read more

Tesla Sued Over Claim Faulty Doors Led to Deaths in Fiery Crash (Tue, 04 Nov 2025)

Tesla Inc. was sued over a crash in Wisconsin last November that killed all five occupants of a Model S who allegedly became trapped in a fast-moving inferno when the doors wouldn’t open, adding to scrutiny over whether a design …

>> Read more

NHTSA: Ford Recalling 79K Vehicles for Door Panel, Lightbar Defects (Tue, 04 Nov 2025)

Ford Motor is recalling 79,781 vehicles in the U.S. that are at risk of having interior panels near the front doors that could detach and rear lights that may stop working, the National Highway Traffic Safety Administration said. The recall …

>> Read more

Samsung Hit With $191.4M Jury Verdict in OLED Patent Trial (Mon, 03 Nov 2025)

Samsung Electronics owes patent owner Pictiva Displays $191.4 million in damages for infringing two U.S. patents covering organic light-emitting diode technology, a jury in Texas federal court said on Monday. Pictiva convinced the jury that a wide range of Samsung …

>> Read more

Should I Hire An Attorney or A Public Adjuster?

Here is a really good video that explains when to use a Public Adjuster and when to use an Attorney to handle your insurance claim. I would say that in almost 95% of situations, you would use a Public Adjuster before an Attorney.

Attorney's usually do not understand how to adjust a claim or speak the same language as adjusters. Rather, an Attorney is necessary when a claim is denied and cannot be re-opened or if all options under the policy have been exhausted and you are still not happy with the outcome.

IN CONCLUSION, HIRE A PUBLIC ADJUSTER TODAY!

Hurricane Wilma: Is It Too Late To File A Claim Or Re-Open My Claim?

The simple answer to this question is NO!

You have up to five years to file a claim and/or re-open a previously filed claim. Since Hurricane Wilma took place on October 24, 2005; you technically have until October 24, 2010 to notify the Insurer Carrier you had at the time of Wilma that you would like to file a claim and/or are interested in re-opening a claim.

I will be cautious to advise that this is not a quick and easy process. Additionally, there are certain insurance companies, such as POE, that are no longer in business and it is too late to file a claim or re-open a claim with such carriers.

However, if you have documentation, invoices, pictures, receipts, etc. for the monies expended and evidence of the damaged that occurred, you are in a much better position.

Give us a call today so we can assist you with this process. Our team of professionals are trained and experienced in dealing with such claims.